Are you having difficulty understanding the IRS Form 8379 when it comes to the Injured Spouse Tax Relief?

You’re probably facing this new challenge because of an unexpected problem…

Everything seemed to be going well with your tax preparation this year until you were unexpectedly told you would not be receiving your refund.

In fact, you would end up giving the entire refund to the IRS for a particular issue unknown to you.

Once you contacted the IRS you learn that your spouse owes money towards a delinquent student loan payment and now the money you were depending on has vanished…

…or so you thought.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. Which means if you click on any of the links, I’ll receive a small commission at no additional cost to you.

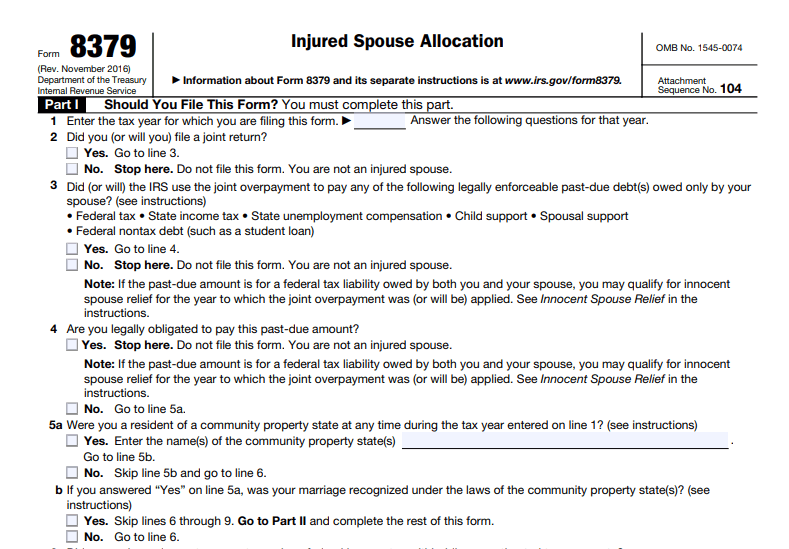

The IRS has a program in place for spouses who may face this unexpected challenge. It’s called the Injured Spouse Tax Relief which is processed through Form 8379 (Injured Spouse Allocation).

Injured Spouse Allocation is when past-due taxes and/or debts have placed your tax refund in danger.

You must file Form 8379 for each year you meet this condition and want your portion of any offset amount refunded.

The Department of Treasury’s Bureau of Fiscal Service (BFS) issues refunds. BFS also operates the Treasury Offset Program (TOP).

Through this program, your refund may be reduced or used to repay any debt, such as:

Power Tip: If you know your partner owes a debt like the ones mentioned, you can file Form 8379. It may take up to 14 weeks for the IRS to process your return and issue a refund if applicable.

If you did not know about your partner’s debt, then you can file Form 8379 by itself.

It must show both spouses’ social security numbers in the same order as they appeared on your joint tax return.

You will also need to include all of your Forms W-2 or 1099 or your refund may be delayed. It can take up to 8 weeks for the IRS to process the form if the issue is discovered later.

Bureau of Fiscal Service (BFS)can take as much of your refund as is needed to pay off the debt.

According to the IRS, if you file a joint return and all or part of your refund is applied against your spouses’ past-due federal tax, state income tax, child or spousal support or federal non-tax debt, such as a student loan, you could be entitled to injured spouse relief.

If you had federal income tax withheld from your paycheck (or if you made estimated tax payments on your self-employment income), the portion of the joint refund represented by those payments will be included in your share.

The IRS also uses a special formula when calculating the Injured Spouse’s share of any overpayment.

(Injured Spouse’s Separate Tax Liability ÷ Total of Spouses’ Separate Tax Liabilities) × (Joint Tax Liability Shown on Return) = Injured Spouse’s Share of Liability

Any additional child tax credits will also be included in your share.

Also, any earned income tax credit will be apportioned between you and your spouse based on each person’s contribution to the joint adjusted gross income.

We now have a background on this topic that you may be facing. Let’s go though a few tips to help you understand it a little bit better.

To be considered an injured spouse, you must have made and reported tax payments, such as federal income tax withheld from wages or estimated tax payments, or claimed a refundable tax credit.

Such as, the earned income credit or additional child tax credit on the joint return, and not be legally obligated to pay the past-due amount.

If you live in a community property state, special rules apply to help you understand if this rule applies to you.

For more information about the factors used to determine whether you are subject to community property laws, see IRS Publication 555, Community Property.

If you filed a joint return and you’re not responsible for the debt, but you are entitled to a portion of the refund you may request your portion of the refund by filing Form 8379, Injured Spouse Allocation.

You may file form 8379 along with your original tax return or you may file it by itself after you are notified of an offset. You can file the Form 8379 electronically.

If you file a paper tax return you can include Form 8379 with your return, write “INJURED SPOUSE” at the top left corner of the Form 1040, 1040A, or 1040EZ. IRS will process your allocation request before an offset occurs.

If you are filing Form 8379 by itself, it must show both spouses’ social security numbers in the same order as they appeared on your income tax return.

You, the “injured” spouse, must sign the form.

Do not use Form 8379 if you are claiming innocent spouse relief. Instead, file Form 8857, Request for Innocent Spouse Relief.

This relief from a joint liability applies only in certain limited circumstances. IRS Publication 971, Innocent Spouse Relief, explains who may qualify, and how to request this relief.

Innocent Spouse Allocation happens when a spouse is unaware of inaccurate information on a joint tax return from their partner.

Whereas Injured Spouse Allocation is needed when past-due taxes and/or debts places your tax refund in danger.

Injured Spouse Allocation (Tax Relief) IRS Form 8379 can BE ELECTRONICALLY FILED with your tax return or sent alone after filing the tax return.

However, Request for Innocent Spouse Relief (IRS Form 8857) is NOT sent with your tax return.

It is only done to request relief from a tax liability, that you think your spouse (former spouse) should have responsibility for.

In regards to using the Injured Spouse Relief, you may be able to show your divorce decree for the tax years that are applicable.

As mentioned earlier, you can do this by filing Form 8379. It may take up to 14 weeks for the IRS to process your return and issue a refund if applicable. You will also need to include all of your Forms (W-2, 1099, etc.) or your refund may be delayed.

As far as obtaining a death certificate, most states grant the surviving spouse the permission to get this document.

However, adult children are may be able to request one. Just be sure to always consult with your tax advisor for information more specific to your needs.

Hope this helps you navigate the muddy waters of the tax season. For more information about the Injured Spouse and Innocent Spouse Relief, visit www.IRS.gov.

Get started on your taxes early here!

Until the next money adventure, take care!

Handy

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: July 30, 2015/Updated March 26, 2021)

Nikida Metellus is a financial freedom advocate, author, and the reimagined voice behind ThemeParkHipster.com, now focused on helping you achieve a debt-free life and financial success. Based in Orlando, Florida, she combines her love for theme parks with actionable financial strategies, offering a unique perspective on balancing fun and finances. As the author of Complete Tax Planning Guide, she has now expanded her expertise to guide you on the road to financial freedom. Co-founder of Bramework and a coffee enthusiast at heart, Nikida is committed to empowering you with practical tips and insights to manage your money wisely. When she's not blogging or exploring Florida's attractions, she enjoys quality time with her husband and two daughters. Welcome to your journey toward a financially free life!