Payroll outsourcing is the use of a third party to help handle the administration of your company’s payroll.

While building your business, you’ve probably had your hand in everything, from hiring employees to running payroll. And while your business may be your pride and joy, it can still be tough to do everything on your own.

To help keep up with your growing business, you might consider outsourcing payroll to shift some responsibilities off your plate, allowing you to spend time on other crucial business tasks.

So how exactly does outsourcing payroll work? And what are the pros and cons of taking this step for your business? Follow this guide to learn more about payroll outsourcing and how it can benefit your business.

Payroll outsourcing services streamline your payroll processing system. Rather than an in-house payroll or HR professional, team manager, or small business owner handling payroll themselves, a third party takes care of the logistics.

These third parties often automate many aspects of payroll, including:

A high-quality payroll outsourcing service provides you with a suite of features for running payroll efficiently. Simple outsourcing options allow you to manage payroll data from a phone or desktop application, while higher-value options allow you to connect directly with expert support. They may also include HR outsourcing features.

Rather than having an in-house team deposit paychecks, calculate tax withholdings, and file your small business taxes , outsourced payroll handles it all behind the scenes. Plus, professional payroll services significantly reduce the chances of errors in your payroll processing.

According to Technavio, the payroll outsourcing services market is estimated to grow nearly 6% by 2027.

Like with any business decision, you’ll want to know how your business will benefit if you decide to outsource your payroll. Now that you know what outsourcing the payroll process entails, let’s look at the wide range of payroll outsourcing benefits it can provide for you and your business.

Whether you’re looking to save some extra time or are interested in additional HR features, outsourcing your payroll could be the right choice for your small business.

Most everything has its pros and cons, and outsourcing payroll is no exception. Before diving into whether or not outsourcing payroll is the correct decision for you and your business, look at some of the downsides.

As with any business decision, it’s up to you to decide whether or not the pros outweigh the cons when looking to improve your current payroll processes.

Now that you’ve weighed the pros and cons of outsourcing payroll, let’s break down some common features to keep an eye out for in payroll outsourcing services.

Once you find a payroll outsourcing service that best fits your needs, you’ll begin the payroll outsourcing process, further explained below.

According to HR Dive, 61% of respondents outsourced payroll processing in 2022.

Outsourcing payroll is easier than it sounds. Plus, a little effort now will save you tons of hassle down the road. Here are the steps you can take to ensure the transition is seamless.

By following these four steps, you can start reaping the benefits of payroll outsourcing and spend your time focusing on other important aspects of your small business.

If outsourcing payroll seems like the best next step for your small business, consider using payroll software . With payroll software, you can easily integrate with your current operations, automate your payroll process, and access 24/7 support from payroll experts.

QuickBooks Online Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/

When it comes to payroll outsourcing, the decision is entirely up to you. Because of this, you'll want to do your research and weigh the pros and cons before deciding whether or not outsourcing payroll is a good idea for your business.

How much does outsourcing payroll cost?The cost of outsourcing payroll can depend on several factors, including your business’s payroll schedule , the size of your business, and your exact payroll needs. If you decide to help streamline your payroll process using payroll software, you can spend as little as $22.50 per month .

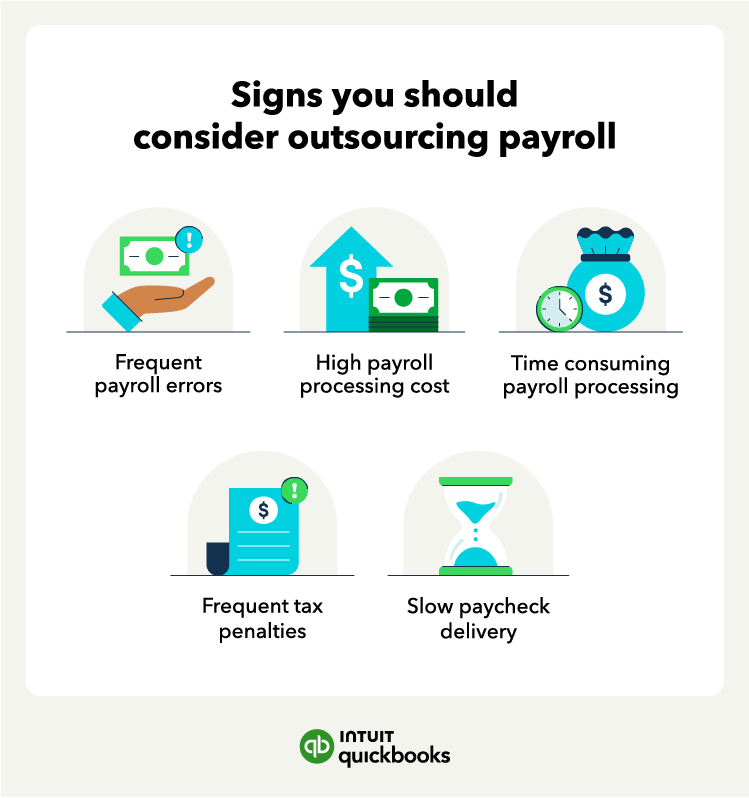

When should you consider outsourcing payroll?If your current system causes frequent mistakes, you may want to consider outsourcing your payroll. After all, payroll mistakes can lead to high costs, wasted time, and lost productivity. It may also lead to a hard time complying with the IRS or labor laws, and employees may experience frustration due to long wait times for paychecks.

What is payroll co-sourcing?Payroll co-sourcing is a type of payroll outsourcing in which a third-party payroll provider and employees of the business share payroll processing responsibilities. That way, a small business is getting the best of both worlds, allowing them to selectively decide what aspects of payroll they do themselves and which they’d rather have done by the experts.

Recommended for you

What is payroll processing? How to process payroll step-by-step

Starting a business

Business owners say you should outsource these 3 tasks

September 25, 2020

How to automate and simplify payroll tax deductions with QuickBooks

February 13, 2020

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.